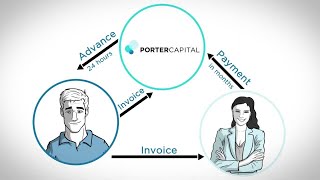

“So let’s break down what the steps are for invoice factoring. First, you’d just have to gather some documents, fill out a quick application. The application’s one page. It should probably take your max. I would say 60 seconds to fill out next. You want to submit a couple bank statements? You know, usually three is good. You can submit six. If you want to do driver’s license, voided, check your articles of incorporation and your detailed accounts receivable report.” – Jonathan Fodera

“So let’s break down what the steps are for invoice factoring. First, you’d just have to gather some documents, fill out a quick application. The application’s one page. It should probably take your max. I would say 60 seconds to fill out next. You want to submit a couple bank statements? You know, usually three is good. You can submit six. If you want to do driver’s license, voided, check your articles of incorporation and your detailed accounts receivable report.” – Jonathan Fodera

To learn more about Integrated Business Financing 👉

https://www.integratedbusinessfinancing.com

https://www.facebook.com/IntegratedBusinessFinancing

Learn more about Jonathan Fodera 👉

https://www.instagram.com/jonathan.fodera/

https://www.linkedin.com/in/jonathan-fodera-391a98a1/

Subscribe to Integrated Business Financing 👉

https://www.youtube.com/channel/UCv9gp1n6t2lmyVicsTXZYeQ

If you found this video valuable, give it a like.

If you know someone who needs to see it, share it.

Leave a comment below with your thoughts.

Add it to a playlist if you want to watch it later.

Integrated Business Financing can help you with financing in all areas: Inventory, expansion, equipment, working capital, Amazon funding, and more. They tailor their programs to meet the specific needs of your business and simplify lending and financing options for businesses of all sizes.

The owner and founder of Integrated Business Financing, Jonathan Fodera, is an experienced Consultant with a demonstrated history of working in the financial services industry. He is skilled in Banking, Sales, Business Development, Entrepreneurship, and Strategic Planning. Jonathan is a strong consulting professional with a Bachelor of Science (BS) focused in Economics from Stony Brook University.

PULLED QUOTES from this video🎙️:

“And we want to see all the companies that you’re working with. Why? Because invoice factoring doesn’t go off of what your score is, what your credit is. It goes off for your clients, and then we’re going to need a sample invoice from there.”

“Next, once you sign a term sheet, you’re going to submit all the current invoices and it’s going to go through an underwriting process that on the writing process, doesn’t take long.”

“So what are some of the things that you can do do today to make sure that, you know, your cashflow is strong and everything’s working properly? Well, first take a look at your accounts receivable report. If you don’t have one and you’re working business, the business or business, the government, that’s a problem.”

Subscribe to Integrated Business Financing 👉

If you know anyone who could use this information, share this video with them. We’re here to help. Thanks for watching. We really hope this information was helpful to you and if it was, please give us a like, comment or subscribe.

Feel free to share this video 👉

Subscribe to our channel 👉

You can also find other content by Jonathan on:

https://jonathanfodera.phonesites.com

Business Master Class 👉

https://businessmasterclass.phonesites.com

Connect with us on social:

📱Facebook: https://www.facebook.com/IntegratedBusinessFinancing

📸Instagram: https://www.instagram.com/jonathan.fodera/

Subscribe to Integrated Business Financing 👉

#invoicefactoring #financialadvice #businessadvice #businessfinancing #integratedbusinessfinancing

To learn more about Integrated Business Financing 👉

https://www.integratedbusinessfinancing.com/

Subscribe to Integrated Business Financing 👉

https://www.youtube.com/channel/UCv9gp1n6t2lmyVicsTXZYeQ