Invoice Factoring and How It Works

At Porter Capital, we understand that traditional financing can sometimes be a slow and complicated process. We work with various clients who may not qualify for traditional loans or those who want a more immediate and flexible way to finance new business opportunities.

At Porter Capital, we understand that traditional financing can sometimes be a slow and complicated process. We work with various clients who may not qualify for traditional loans or those who want a more immediate and flexible way to finance new business opportunities.

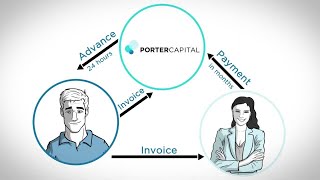

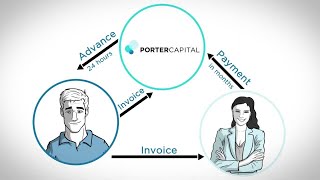

Invoice financing, also known as accounts receivable financing, is when a factoring company purchases your business invoices to provide you with fast payments. Instead of waiting months for customers to pay, Porter Capital advances up to 90% of the invoice amount in as little as 24 hours.

If you’re dealing with rapid growth, want to expand your business, bankruptcy, or are looking for more efficient ways to finance your business, invoice financing might be the perfect solution for your business needs.

Porter Capital has provided businesses with working capital solutions for nearly 30 years through custom loan solutions and credit lines of up to $15 million. Factoring your invoices with Porter Capital makes getting the business funding you need to grow quick and easy.

Apply now: https://www.portercap.com/apply-fb

Subscribe to our channel: https://www.youtube.com/channel/UCn_VB5376ry6JZgM5NTWxIQ/?sub_confirmation=1

Connect with us:

Facebook: https://www.facebook.com/portercapital

Twitter: https://twitter.com/Porter_Cap

Instagram: https://www.instagram.com/porter_cap/

LinkedIn: https://www.linkedin.com/company/porter-capital

#InvoiceFactoring #invoiceFinancing

Easy and practical. Custom loan solution, funds available in 24 hours, and outstanding CS.

Thanks, this helped a lot!

Where can I sign up for ISO agreement/ Partnership program??

Simple and straightforward

Thank you for clearing up my confusion

Interesting, what do you need to open a factoring company?

Wow, nice editing. What did you use?

very helpful

Hello, what is the factoring fee that you charge?